The Chinese e-commerce sector has experienced unrivalled development in the last decade, turning China into the largest e-commerce market in the world. Online retail, for fashion, groceries and even cars, is becoming part of local consumers’ daily habits thanks to an always-on smartphone-focused approach.

It is therefore no coincidence that brands and retailers from all over the world are eager to launch on China’s online platforms. The five steps below should provide a basic overview of what foreign retails should consider before taking the step into the market.

1. Conduct your market research

Will your product actually sell in China? Are there local or international competitors already in your space and already in the market? Make sure you do the obvious market research at the very first stage, before spending a lot of money and time establishing an e-commerce presence.

Looking at where overseas Chinese visitors go shopping and what they buy can be a great piece of low-cost early research to find out what Chinese consumers like and don’t like. If you can, make a trip to China and have a look for yourself to see if there are competitor products, how they’re priced, and the quality of them. Try to build a profile of your ideal customer, as identifying who will be most receptive to your brand heritage and story will help determine which geographical areas and demographics to target.

China has multiple consumer bases: young and old, rural and urban, top-tier and lower tier, luxury and bulk buy – so determining the customer profile for your brand is essential.

2. Choose the right platform

China has many e-commerce platforms that target a whole range of different audiences. Some are targeting luxury spenders, some are aimed at group buyers. Some focus on first-tier cities whilst others target the third- and fourth-tier cities. Make sure you know your audience so that you can work with the most suitable platform for your needs. TMall Global, JD.com Worldwide and Xiao Hong Shu are three of the larger platforms that enable Cross Border E-Commerce (CBEC) sales but there are a many more out there.

TMall (for domestic sales) and TMall Global (for CBEC sales) are owned by Alibaba and see record-breaking sales revenues every year during the November 11th Singles Day. TMall is popular with shoppers looking for luxury, accessories and general FMCGs. JD (Jindong) initially started out as the go-to site for electric appliances but has now branched out to cover everything from fresh food to clothing to cosmetics. Xiao Hong Shu (Little Red Book) has become incredibly poplar among China’s youth and affluent women living in urban coastal regions of China.

Selling into China also doesn’t have to mean working with an e-commerce platform. Increasingly, companies are also using their own website to sell directly into market, which offers more control, higher margins and better data collection but also involves a lot of work making your global website China-friendly.

3. Make sure you are legal

The advent of new cross border e-commerce (CBEC) regulations allows overseas sellers to sell directly into China without having to have a registered Chinese entity at all. Nearly all major Chinese e-commerce platforms have a ‘global’ or ‘international’ element to allow international sellers to use the platform via CBEC without having to have a Chinese set up.

CBEC obviously also has a more limited reach than with a Chinese entity and presence on the ground. But CBEC is great for testing the market, with a lower risk entry route that lets you dip your toe in the water and gradually build from there. However, don’t expect overnight results – a good marketing strategy and budget is essential to be heard through all the noise.

Some of the larger e-commerce platforms won’t work with smaller start-ups, regardless of where you are from, and most require foreign companies to work with a Third Party (TP) who can manage the platform, logistics, and customer service. Companies without trademark registration also find themselves rejected from nearly all sites, partly to stop time-wasters and counterfeiters.

4. Know your licenses and tax

The Chinese government launched a positive list in 2016 that featured 1,142 product categories that could be legally imported into China via CBEC. This was updated in 2018 with a further 151 items added. The positive list covers many product categories, including clothing, some food and drink products, beauty and more; but there are still many products that are not licensed for sale via this route. Any products not on this positive list are subject to limitations, product registration, licensing or tariffs and include products such as baby milk powder, cosmetics, health food and medical devices.

For products not on the positive list, it is worth considering working with a licensed local agent or a third-party company that can help navigate the often complex paperwork involved in the registration process. Standard tariffs, tax and VAT will be included on the products and vary depending on the product in question and the price of the product. VAT and duties are usually paid by the buyer at the time of purchase.

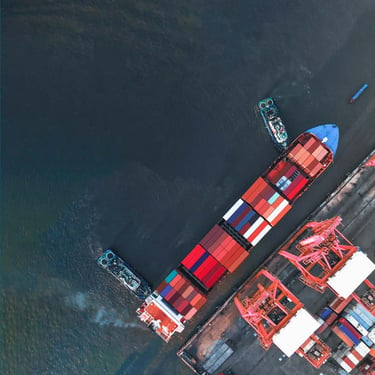

5. Get your logistics in place

There are multiple ways of getting goods sold via CBEC to your consumer in China. Some platforms, such as Tmall Global, offer a ‘fulfilled by’ service much like Amazon, while relatively smaller platforms rely on the vendor to fulfil themselves. This can either be done through a bonded warehouse in a free trade zone – which requires a partner to manage the process but greatly improves the consumer experience and delivery time – or by shipping directly to the consumer from overseas via postal channels. This takes longer to deliver and requires the buyer to deal with paying duties on arrival but reduces stock management issues and risk for the vendor. It is important to be sure that the route you choose is right for your price point and product type – providers such as Royal Mail offer different services to suit different retailers’ needs.

This article was written by Hawksford China team for CBBC (China-Britain Business Council) Focus Magazine.