Starting a business in New Zealand

Known for its business-friendly policies, the country offers a blend of government support and entrepreneurial freedom. From low-cost legal advice to tailored mentoring programs and startup grants for eligible businesses, New Zealand provides a comprehensive framework to foster business growth. Initiatives such as Business Mentors New Zealand and the Regional Business Partner Network further simplify the company formation process.

Entrepreneurs benefit from personalised guidance, access to a vast network of mentors, and essential resources that make scaling and managing a business in New Zealand both efficient and rewarding. If you're planning to start a business in New Zealand, this guide explores the country's advantages and the common business structures for registration.

Why choose New Zealand?

Initiatives such as Business Mentors New Zealand and the Regional Business Partner Network further simplify the company formation process. Entrepreneurs benefit from personalised guidance, access to a vast network of mentors, and essential resources that make scaling and managing a business in New Zealand both efficient and rewarding.

New Zealand's unique combination of factors creates a highly favourable environment for businesses to thrive. Here are some key differentiators that make New Zealand an emerging destination for entrepreneurs:

Conducive economic climate

According to the World Bank’s Doing Business 2020 report, New Zealand ranks at the top for ease of doing business. This includes areas like registering a business and securing credit to operate effectively. New Zealand's strong focus on international trade supports its economy, especially in agriculture, forestry, and energy sectors. The country also excels in registering property, enforcing contracts, and protecting minority investors.

With one of the most developed financial systems globally, New Zealand offers a business-friendly environment. New Zealand’s strategic location also allows companies to service customers across major global markets like the US, UK, and Asia.

Tax benefits

Incorporating a company in New Zealand offers several tax advantages. The corporate tax rate is 28%, which is lower than the top personal income tax rate of 39%, making it more tax-efficient for businesses to operate as companies compared to sole proprietorships or partnerships.

Companies can also carry forward tax losses to offset future taxable income, helping reduce future tax liabilities. This feature is available to companies but may not apply as easily to sole traders or partnerships. Capital gains tax is generally not imposed on companies, meaning profits from selling capital assets are typically not taxed. However, individuals and companies could be subject to capital gains tax under specific circumstances, such as property sales that fall under the bright-line test for residential properties.

New Zealand has a broad-based tax system, including income tax and goods and services tax (GST), but no payroll tax, inheritance tax, stamp duty, or local/state income taxes. With a network of over 40 double-tax agreements with key trading partners, New Zealand’s tax environment remains attractive for international businesses and investors.

Pro-business government incentives

New Zealand offers a supportive and dynamic start-up environment for aspiring entrepreneurs. The government provides various resources to help new businesses sustain. For example, the business training and advice grant connects entrepreneurs with mentors who offer training and guidance.

The more fully formed your business idea is, the more help you can get. Many free or low-cost start-up and founder support opportunities are available if you are in the early stages of business. Initiatives like the Flexi-Wage Subsidy also help reduce financial pressure, highlighting New Zealand's commitment to fostering a favourable business environment.

Strong legal and foreign exchange policies

New Zealand’s legal system is based on common law principles similar to those in Australia and the UK. The country is also known for its simple foreign exchange controls. The country is popular with entrepreneurs as there are no restrictions on the flow of capital from a New Zealand company to foreign investors.

Foreign investment in the country is monitored by the Overseas Investment Office, the Financial Markets Authority, and the Reserve Bank of New Zealand. These institutions regulate the markets through monetary policy and regulation.

Global financial hub with trade agreements

New Zealand's free trade agreements (FTAs) provide companies with a strategic advantage in accessing global markets. For instance, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) opens opportunities across the Asia-Pacific region, while the New Zealand-European Union Free Trade Agreement (NZ-EU FTA) strengthens trade ties with Europe. These agreements help businesses reduce tariffs, streamline trade regulations, and expand their international reach.

The trading environment in New Zealand is highly favourable due to its low tariffs, minimal trade restrictions, and efficient customs processes. It allows businesses to operate with fewer constraints compared to many other countries.

Learn more about our entity formation and administration services

We have considerable experience supporting clients of all sizes with the formation and administration of companies, trusts, foundations and partnerships across key jurisdictions.

Business structures in New Zealand

Once you decide to start a company in New Zealand, there are different ways to structure your business. Each business structure has different legal and financial obligations. If you want to start your company in the country, here are the business structures for your consideration.

Limited liability companies

Limited liability companies (LLCs) in New Zealand operate under the Companies Act 1993, offering business owners limited liability protection. This means the company is a separate legal entity from its owners, protecting personal assets from business liabilities. LLCs also provide significant flexibility in ownership and management, making them a popular choice for entrepreneurs.

To establish an LLC in New Zealand, the company must have at least one director, one shareholder, and a registered physical office address. There are no minimum capital requirements, and there are no limits on the number of directors or shareholders. However, LLCs must file annual returns with the Companies Office to remain compliant.

Limited partnership

The Limited Partnerships Act 2008 governs limited partnerships (LPs) in New Zealand. An LP must include at least one general partner and one limited partner. The general partner manages daily operations and is fully liable for business debts, while the limited partner has no operational control and is only liable up to their investment.

Limited partnerships benefit from "pass-through" tax treatment, meaning profits and losses are directly passed to partners without additional corporate tax. Business owners must apply to the Companies Office, along with details of partners and a physical New Zealand address. An annual return is required; larger partnerships may need audited financial statements.

Branch office

A branch office in New Zealand is an extension of the parent company and is not considered a separate legal entity. Foreign companies can set up a branch to conduct business, with the parent company remaining responsible for all debts and obligations. The branch office must have a resident representative and a legal address. It should also have a local management body. The parent company representative must open a local corporate bank account.

The branch must file audited financial statements and pay corporate income tax on New Zealand profits. The branch must register on the Companies Office’s Overseas Register and meet reporting requirements like annual returns and director updates.

Branch offices are often used when a parent company wants to retain full control and doesn't require the formation of a separate legal entity.

Trusts

Trusts are another popular business structure in New Zealand, particularly for asset management and investment purposes. Trusts can hold a wide variety of assets, including real estate, shares, and intellectual property, making them attractive for both personal and business arrangements.

In a trust, a settlor transfers assets to trustees, who manage them for the benefit of designated beneficiaries. Trustees are legally responsible for managing the assets according to the trust deed and are liable for any breaches of their fiduciary duties.

The structure is particularly beneficial for high-net-worth individuals or families and companies seeking long-term asset management solutions.

“We’ve been working with Hawksford since 2012 when we decided to set up our own entities in Asia. The team is very professional and helpful. They took care of every step of business formation, giving us advice and responding to our needs in a timely manner."

Sophia Zhou, APAC Finance Controller, Moleskine China

- Table of contents

- Why choose New Zealand?

- Business structures in New Zealand

- Next steps

Next steps

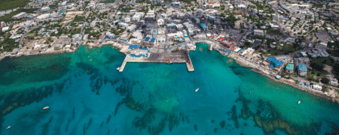

If you are considering New Zealand as your destination for starting a business, you will need to assess which city to set up in. Depending on your needs, some options you might consider include Auckland, Wellington, Christchurch, and Hamilton. As an international provider of corporate services, Hawksford can advise you on this and more.

At Hawksford, we have expertise in this area and provide services for your business needs in New Zealand. Reach out to us to begin setting up your company.

Contact our experts

We aim to make every interaction with you meaningful. Tell us a little about you and your ambitions and our team will be in touch.

Explore further New Zealand focused resources

Knowledge sharing is an essential part of our philosophy. Our news and insights bring together the latest industry analysis and international business news, along with updates about the Hawksford group and our people.