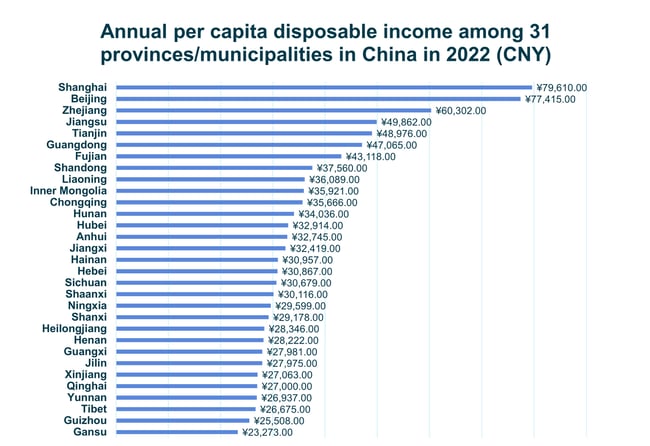

China is a large country with a population of 1.4 billion people and 34 provincial-level administrative regions. It covers 9.6 million square kilometres and spans five time zones from east to west, which is about 5,200 kilometres in length. The level of economic development varies significantly among different cities. The following graph shows the annual per capita disposable income of 2022 is high in the east and south, compared to the west and north, where it is low.

(Source: National Bureau of Statistics)

The differences in economic development in various regions also means very different wage levels and welfare policies across the cities. Here are a few examples.

Different standards of minimum wages

China’s policymakers introduced the minimum wage to guarantee the basic earnings of workers. It is the lowest remuneration that employers can legally pay their employees on the condition that the employees have provided normal labor. According to the Labor Law of the People’s Republic of China, China shall implement a system of guaranteed minimum wages, and wages paid to workers by employers shall not be lower than the local standards of minimum wages. The local government will adjust the minimum wages every year as the cost of living, the average wage of employees, and the level of economic development changes. For example, the monthly minimum wage of Shanghai in 2023 is CNY 2,690 (effective from 1st July 2023), while that of Gansu Province is between CNY 1,670 and CNY 1,820 for different groups of workers (data collected as of June 2023). The minimum wage represents the take-home pay, which does not include:

- Salary for the extension of working hours.

- Allowances for mid-day shift, night shift, working in high temperatures, low temperatures, underground, toxic and harmful, and other special environments and conditions.

- Food subsidies (meal allowance), commuting subsidies, and housing subsidies.

Different social security systems across regions

Social security policies cover multiple types of insurance such as basic pension insurance, unemployment insurance, work-related injury insurance, maternity insurance, and minimum social security benefit. Different departments often formulate different types of insurance. In addition, the contribution level of the social security provident fund and its way of management vary from region to region. There are different systems and policies within the same province or the same city. For example, the social security provident fund system in Shenzhen, Guangdong Province is different from that of other cities in Guangdong Province. There are two different standards even in the same city of Shenzhen, one applies to residents with a Shenzhen hukou (household registration), and the other applies to those without a Shenzhen hukou. Moreover, there are three types of medical insurance available for Shenzhen employers to choose from.

| Beijing | Shanghai | Guangzhou | ||||

| Social Benefits | By Employer | By Employee | By Employer | By Employee | By Employer | By Employee |

| Pension insurance | 16% | 8% | 16% | 8% | 14% | 8% |

| Medical and maternity insurance | 9.8% | 2% + CNY 3 | 10% | 2% | 6.85% | 2% |

| Unemployment insurance | 0.5% | 0.5% | 0.5% | 0.5% | 0.8% (effective until 31 December 2024) | 0.2% |

| Work injury insurance | 0.2% - 1.9% (with floating premium) | NA | 0.16% - 1.52% | NA | 0.2% - 1.4% | NA |

| Housing fund | 5% - 12% | 5% - 12% | 5% - 7% | 5% - 7% | 5% - 12% | 5% - 12% |

(Remark: Given that the social insurance rates may change every year, the table above includes the current types and rates of social insurance applicable in three major cities in China and is for reference only. Please contact our HR and payroll services team for case-by-case support.

Different welfare leave policies across regions

Suppose a company has branches in many cities across the country, it may experience different treatments for its female employees in relation to the maternity leave as the local wage, welfare policies, and operation procedures are different in each city.

Here are some examples to illustrate the difference:

- Female employees working in Shanghai applying for maternity leave: In Shanghai, maternity leave contains 98 days maternity leave + 60 extra days off. During the maternity leave, the company will stop paying the employee, who shall apply to the government for maternity allowance. The employee’s spouse can apply to his company for 10 days of paid paternity leave

- Female employees working in Guangzhou applying for maternity leave: In Guangzhou, the maternity leave contains 98 days maternity leave + 80 extra days off. During the maternity leave, the company will continue to pay the employee and apply to the government for maternity allowance. The employee’s spouse can apply to his company for 15 days of paid paternity leave.

- Female employees working in Chengdu applying for maternity leave: In Chengdu, the maternity leave contains 98 days maternity leave + 60 extra days off. During the maternity leave, the company will continue to pay the employee and apply to the government for maternity allowance. The employee’s spouse can apply to his company for 20 days of paid paternity leave.

In addition to the 98-day maternity leave stipulated by the central government, each region has different policies on extra days off, paternity leave, and maternity allowance application procedures and operations.

The above examples only show a fraction of the differences between regions. The differences across regions represents a huge challenge especially for foreign companies when managing their human resources and calculating salaries for their local employees. It is advisable to entrust reliable HR professionals like Hawksford to ensure labour and employment-related issues are dealt in accordance to the Law of China and local policies minimising the labour risks.

The new individual income tax (IIT) policy

Labour policies are constantly updating ad evolving. It is worth mentioning the latest Regulations for the Implementation of the Individual Income Tax Law of the PRC, which came into force on the 1st of January 2019, that has not only changed the computation method of China’s Individual Income Tax but has also introduced new income categories and the yearly reconciliation timeframe. The IIT calculation method is based on a cumulative and progressive rate that takes into consideration the total income generated over the year, rather than during each month, although the IIT payment is due on a monthly basis.

Learn more details about the calculation of IIT and yearly IIT reconciliation filing, please check the guide here.

Simplify your payroll with Hawksford

Contact our experts to find out about our payroll outsourcing services.