All you need to know about ‘fapiao’ (invoices) in China

29 January 2021 | Guide

When doing business in China, many foreign operators may have been asked the same question by their suppliers and clients: ‘Can you issue a fapiao?’

So, what is a fapiao? How can it be used and issued? This article provides foreign-invested enterprises, especially newly established ones, with the answers they need.

Current fapiao management practice

In China, fapiao (meaning invoice) is a tax receipt and works as an important accounting voucher for taxpayers to support the legitimacy of their economic activities. Enterprises registered in China are currently eligible for issuing two types of invoices, hereinafter referred to as fapiao:

- General VAT fapiao

- Special VAT fapiao

The difference between the two is that the special VAT fapiao can be used for tax deduction by general taxpayers whose turnover is above RMB 5 million or newly established companies that have applied voluntarily for such status, while the general VAT fapiao cannot.

These two types of fapiao have been available for a long time in paper form. The accountant in charge would purchase (now they are available for free from the local tax bureau) numbered papers (i.e. fapiao) from the local tax bureau to use them for fapiao issuance to be distributed by selected providers. Once the tax receipt had been confirmed by the relevant finance team, it would be sealed with a dedicated invoice seal showing the issuer’s name and tax identification code.

For newly established companies, there is a standard threshold of the number of VAT fapiao that can be issued every month, equal to 25 special fapiao valued at RMB 10,000 per fapiao and 50 general fapiao valued at RMB 10,000 per fapiao.

If the company needs to invoice for a higher amount, a special application for a temporary increase shall be submitted to the tax bureau. After 3 consecutive months of the fapiao being fully used and within specific requirements, companies can apply for a permanent increase to RMB 100,000 per fapiao.

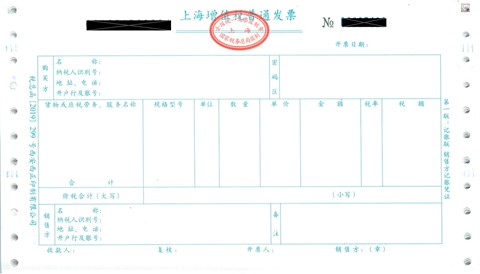

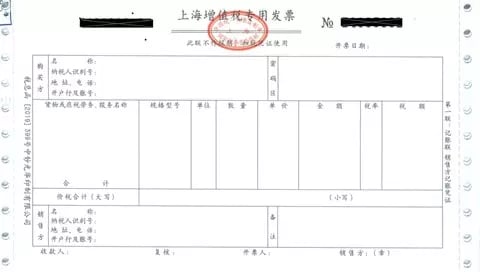

Examples of blank general and special VAT fapiao forms are shown below:

General VAT fapiao

Special VAT fapiao

China first rolled out the electronic general fapiao in 2015, which achieved great success among retail, food and beverage and other high-frequency transaction industries due to the number of tax receipt requests from the public being met by a dedicated electronic fapiao portal that helps speed up tax receipt issuance.

The electronic general fapiao is now in a more advanced state of development where third parties provide automatic and semi-automatic systems that give the user (i.e. the consumer) the capability to request and issue an electronic general fapiao by inputting relevant company information in a dedicated portal without the help of an operator.

New application of electronic special VAT fapiao in China

Before 20 December 2020, the electronic fapiao was only applicable to general VAT fapiao while the special VAT fapiao were still in a paper format.

The success of the electronic fapiao among the public, mainly in the B2C field, has thus encouraged Chinese tax authorities to apply a similar system to B2B transactions, simultaneously granting the relevant authorities more power to monitor tax evasion.

Announcement No. 22 [2020] issued by the State Taxation Administration (STA) on 20 December 2020 extends the possibility of issuing electronic special fapiao solely to newly established companies in China (whose date of establishment or tax registration was after 20 December 2020) for the time being in a selected number of pilot locations divided into two batches, as detailed below.

| Batches | Implementation date | Province/city |

| First batch | 21 December 2020 | Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Anhui, Guangdong, Chongqing, Sichuan, Ningbo and Shenzhen |

| Second batch | 21 January 2021 | Beijing, Shanxi, Neimenggu, Liaoning, Jilin, Heilongjiang, Fujian, Jiangxi, Shandong, Henan, Hubei, Hunan, Guangxi, Hainan, Guizhou, Yunnan, Xizang, Shanxi, Gansu, Qinghai, Ningxia, Xinjiang, Dalian, Xiamen and Qingdao |

* Electronic special VAT fapiao recipients can be nationwide.

Newly established companies in these cities/provinces may use the electronic special VAT fapiao instead of the traditional paper special VAT fapiao for tax registration.

Paper special VAT fapiao vs. electronic special VAT fapiao

| Items | Paper special VAT fapiao | Electronic special VAT fapiao |

| Format | Paper | Digital |

| Invoice copies | Three forms and three copies: the invoice copy, the copy for offsetting tax (the offset copy) and the copy for keeping accounts (the book-keeping copy) | Only one electronic copy |

| Validity | Invoice seal | Electronic signature |

| Authentication | Tax bureau, scanning equipment | Online invoice reader |

| Invoice loss | Subject to the lost copy/ies, the taxpayer will need to obtain evidence and re-stamp the other copies | Re-download through the VAT verification platform based on the fapiao code, fapiao number, date of issue and issued amount (tax excluded). Alternatively, ask the issuer to reissue the electronic fapiao |

| Invoice issuance | Manual self-issuance or automatic 3rd party service provider schemes | Manual self-issuance |

There is no functional difference between the paper special VAT fapiao and electronic special VAT fapiao.

Advantages of electronic special VAT fapiao

This new invoicing process will lead to more cost-effective, environmentally friendly, streamlined and accurate business practice while also bringing about significant changes in the way businesses send and receive invoices in the years ahead, thereby contributing to the development of high-quality account reconciliation.

Some advantages are listed below:

Cost saving

The fapiao issuer can issue the electronic special VAT fapiao with a U-Key and a computer with an internet connection, meaning that a printer is no longer needed for the fapiao.

The issuance of electronic VAT fapiao will become very useful, freeing up employees to focus on other tasks and contribute to other areas. In future, technologies such as artificial intelligence and blockchain will change the game by drastically optimising manpower and time costs, while also preventing human error and fraud.

Efficient delivery

Electronic special VAT fapiao can be delivered by e-mail, link or QR code, with instant delivery allowing companies to speed up their payment collection process while minimising courier and postage expenses.

Traceable records

Unlike the paper fapiao, electronic special VAT fapiao can be easily tracked and matched with each transaction.

A more economical way of preserving fapiao

Paper fapiao can be easily damaged, worn off or lost due to improper storage, while electronic special VAT fapiao can be permanently preserved in a digital format; they do not need to be stored in a specific place and can also greatly reduce the cost of subsequent storage management.

In addition, taxpayers can repeatedly download electronic special VAT fapiao from the free channel provided by the STA in case of invoice loss and damage.

Reliable authentication technology

Electronic special VAT fapiao can be verified by a specified system developed by the STA called ‘Fapiao Reader’, which has been released to help in taxpayer invoice verification.

How to issue electronic special VAT fapiao

The STA has developed a dedicated portal for issuing electronic special VAT fapiao (previously only available in the paper format) accessible to designated taxpayers via a U-Key to be provided for free to newly established enterprises in the aforementioned areas, at each local tax bureau available in the territory.

Authentication technology is incorporated into the new e-invoicing system to guarantee the legitimacy and monitoring of tax receipts, while taxpayers can also access a separate platform created by the Chinese tax authorities called ‘Fapiao Reader’ to verify any e-fapiao received from suppliers, available via the following link: https://inv-veri.chinatax.gov.cn/xgxz.html.

Electronic special VAT fapiao cancellation

As per STA Announcement [C.7], a red electronic special VAT fapiao shall be issued in cases of sales returns, invoice errors, suspension of tax services and sales discount according to the following instructions:

- If the purchaser has used the electronic special VAT fapiao for declarations and deductions, the purchaser needs to fill in and upload the information form for issuing red electronic special VAT fapiao (hereinafter the information form) to the fapiao management system (hereinafter the fapiao system), and shall not fill in the corresponding information for the blue electronic VAT fapiao when filling in the information form. If the purchaser hasn’t used the electronic special VAT fapiao for declarations and deductions, the seller shall fill in and upload the information form to the fapiao system, and shall fill in the corresponding blue electronic VAT fapiao when filling in the information form.

- The taxpayer can submit the information form online, which will be automatically checked for approval by the system. The system will then generate an information form with a red fapiao information serial number and this information is synchronised with the system used by the taxpayer.

- The seller shall issue a red electronic special VAT fapiao in the invoice system, with the information form approved by the tax authorities’ system. The red electronic special VAT fapiao content should be consistent with that on the information form.

- If the purchaser has used the electronic special VAT fapiao for declarations and deductions, the payable VAT listed in the information form shall be temporarily transferred from the payable current income tax, and after obtaining the red electronic special VAT fapiao issued by the seller, it shall be used as an accounting voucher together with the information form.

Impacts on existing companies

Newly established companies can either issue electronic special VAT fapiao or paper special VAT fapiao so that fapiao receivers (likely to be existing companies) can still request for a special VAT fapiao in its paper format, with issuers being obliged to issue the paper special VAT fapiao upon request.

The settlement cycle in the supply chain will undoubtedly become more efficient with the introduction of electronic special VAT fapiao. However, existing companies are likely to go through a transitional learning curve period, including but not limited to learning to use the new VAT issuance system, new standard operating procedures for invoice issuance, tax filing, bookkeeping, and more importantly, communications with upstream and downstream companies for daily operations.

We anticipate a trend whereby existing companies using paper fapiao will gradually switch to electronic formats in future, with the rapid development and upgrade of the e-fapiao system being promising.

How can Hawksford help?

Hawksford has over ten years’ experience in providing corporate accounting and taxation solutions. Our skilled team of experts can provide you with up-to-date and relevant advice. We offer a broad range of solutions that can be customised to the unique needs of both individuals and companies. You can leave all your day-to-day accounting and tax worries to us so that you can focus on your business.

Our specialised services include but are not limited to:

- Corporate and personal tax calculation and filing

- Tax compliance, advice and implementation

- Monthly and yearly bookkeeping and taxation services

Speak to our experts today

Explore how our corporate services can elevate your business needs

Subscribe to insights and guides

Most recent articles

A guide to international expansion

This guide details the major benefits of international expansion, the challenges involved and how we can help you meet them as you grow your business.